Edenred's business model, which generates a high volume of cash and consumes a small amount of capital, enables the Group to maintain a strong financial position.

Rating, debt and invested funds

Rating

Edenred is rated A- Outlook Stable, i.e. “Strong Investment Grade” by Standard & Poor’s. The rating has been affirmed by Standard & Poor’s in December 2024.

This rating is based on a multi-criteria analysis, appraising:

- the business profile of the Group, rated “Strong”, reflecting its leading services and payments platform and the everyday companion for people at work;

- its financial position, rated “Minimal”, in respect of Edenred’s sustainable financial position and its cash-flows generating business model.

Sustainable finance

True to its purpose “Enrich connections. For good.”, Edenred has issued a Sustainability‐Linked Bond Framework to further integrate sustainable development into its economic performance.

This framework aims at aligning Edenred’s business and financing with its commitments and values, by creating a direct link between its sustainability strategy and the funding strategy after having already included environmental and social KPIs in its 2020 Revolving Credit Facility.

The Framework has been established in accordance with the Sustainability-Linked Bond Principles (SLBP) administered by ICMA and reviewed by EthiFinance who provided a Second Party Opinion.

- Sustainability‐Linked Bond Framework (PDF, 2.3 MB)

- Second Party Opinion by EthiFinance, June 2021 (PDF, 1 MB)

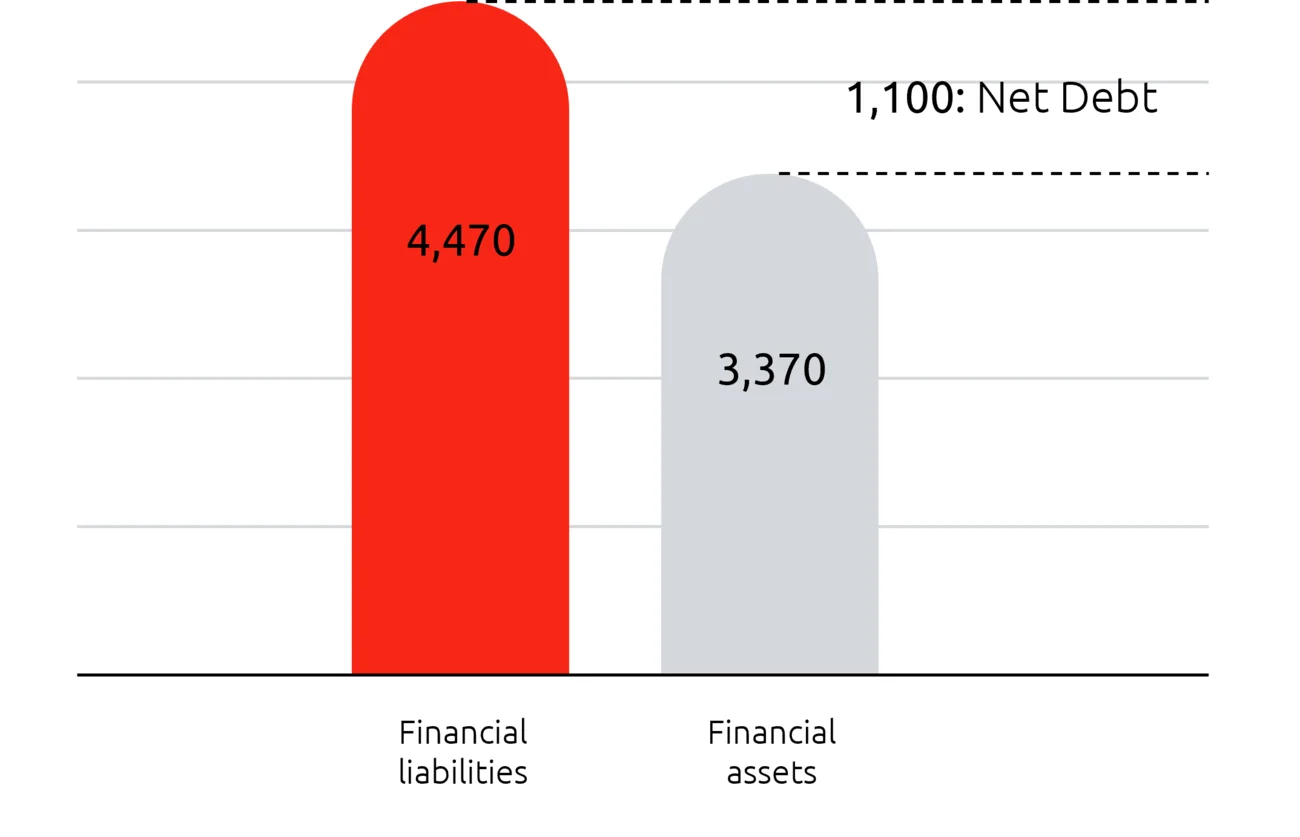

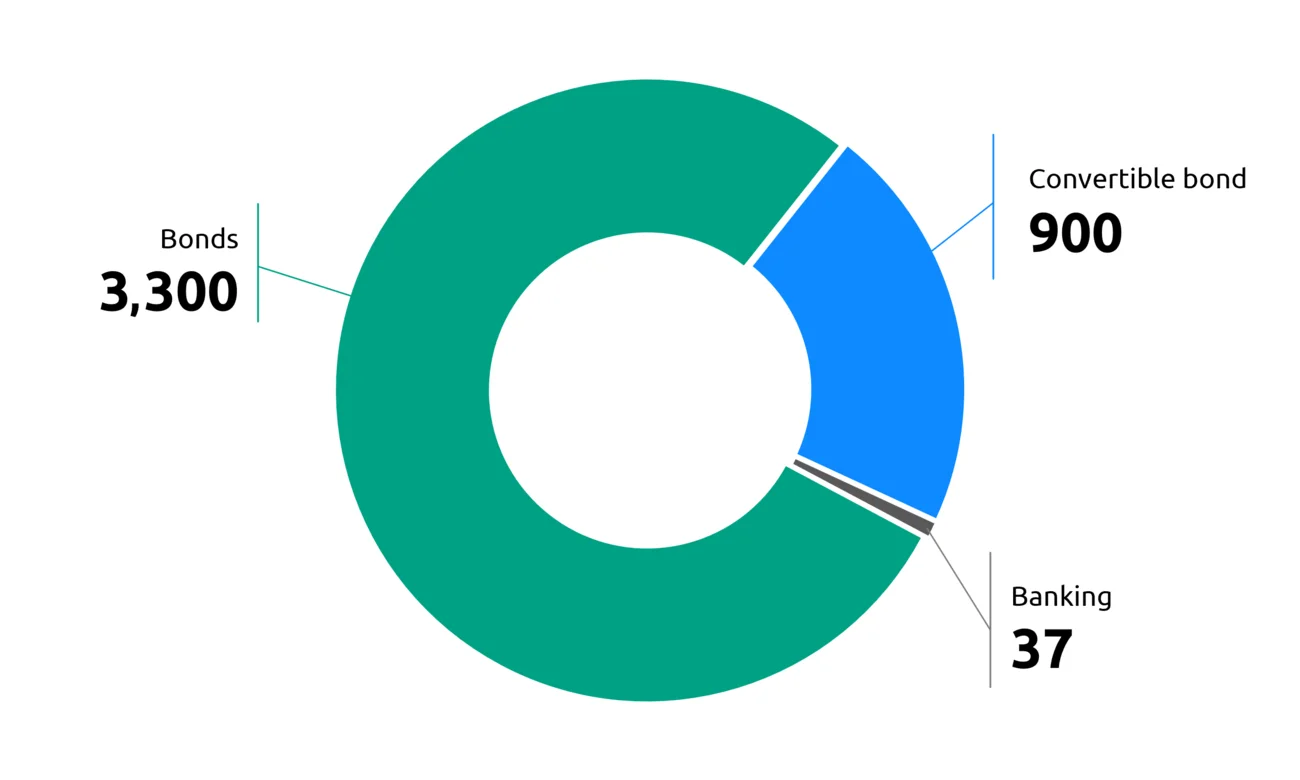

Debt structure at end December 2024

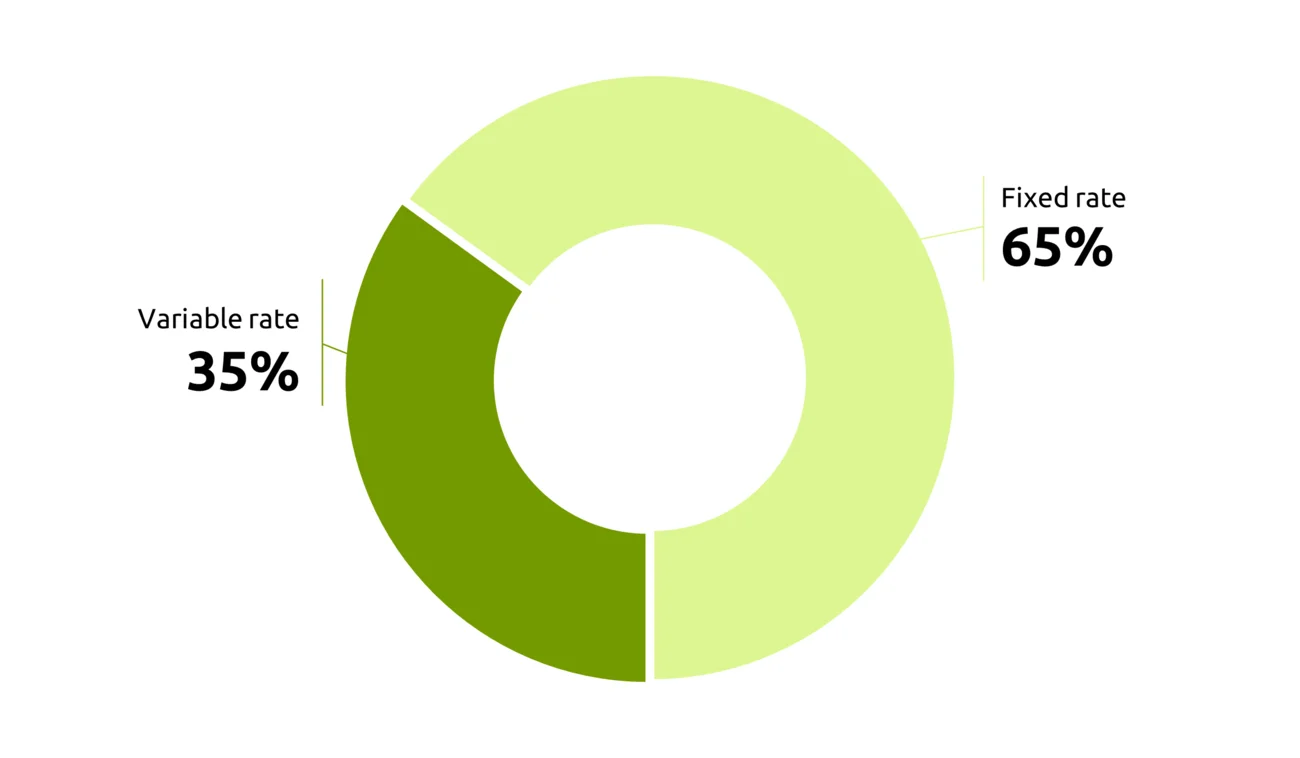

Gross debt cost as of December 31, 2024

| Before hedging | 2.4% |

|---|---|

| After hedging | 3.4% |

Confirmed lines of credit

As of December 31, 2024, Edenred had a €750 million undrawn confirmed line of credit, expiring at the end of February 2027. This facility will be used for general corporate purposes.

Investments

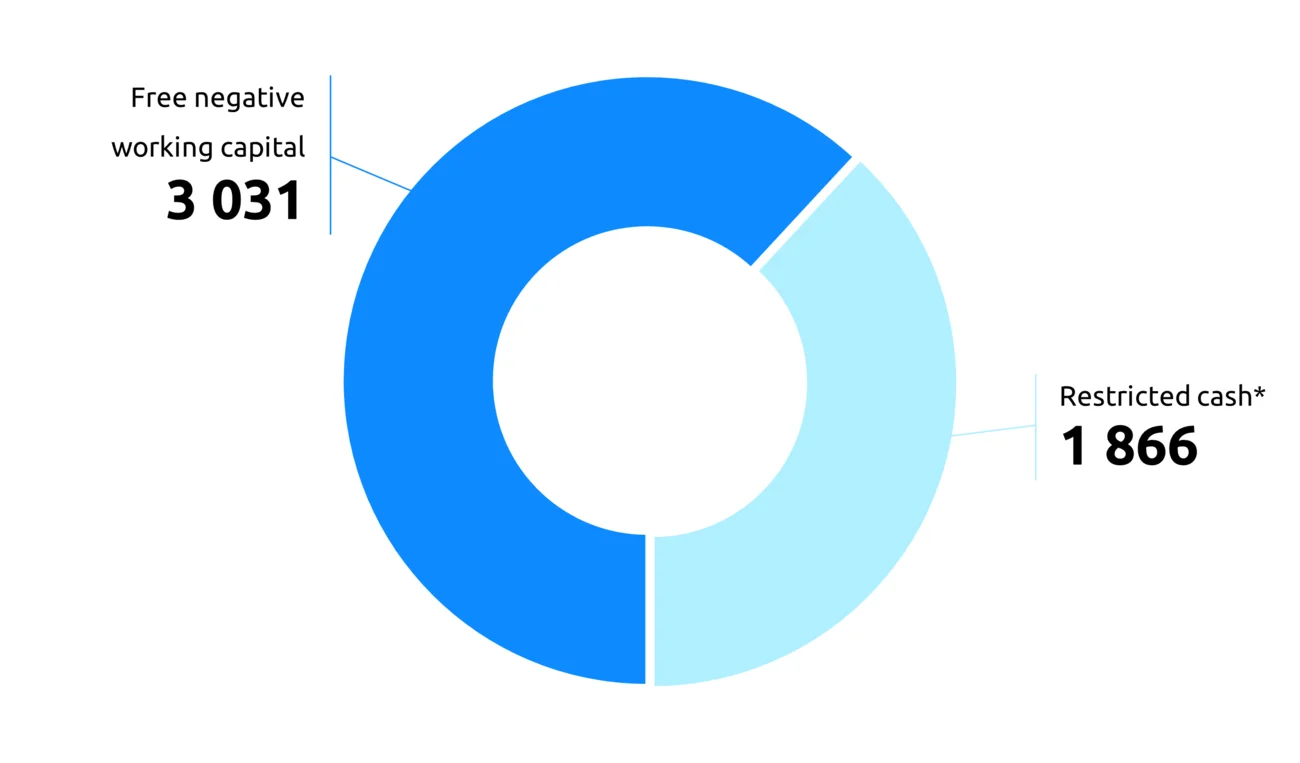

The Group’s negative working capital amounted to €4.9 billion as of December 31, 2024.

Negative working capital (WC) breakdown as of December 31, 2024

In € million

* Restricted cash are funds which correspond to prepaid service vouchers under special regulations. They are excluded when calculating the net debt.

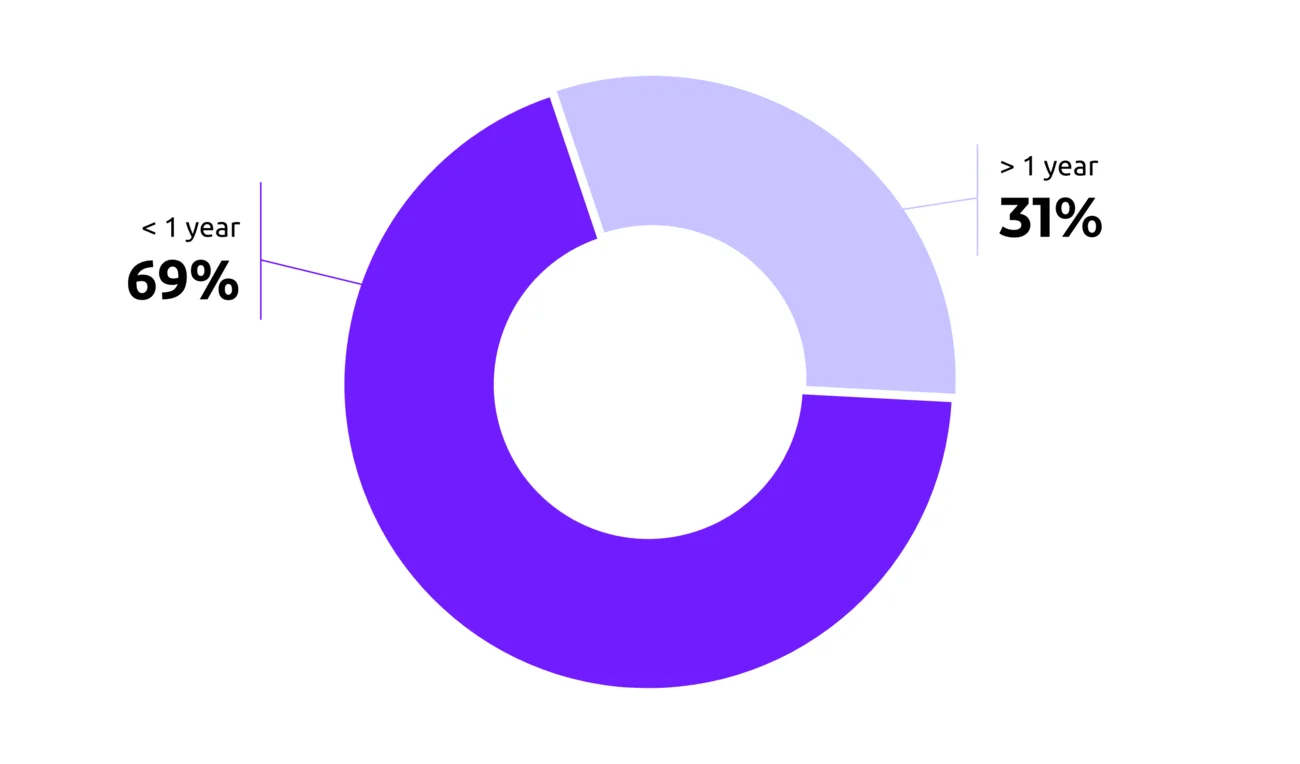

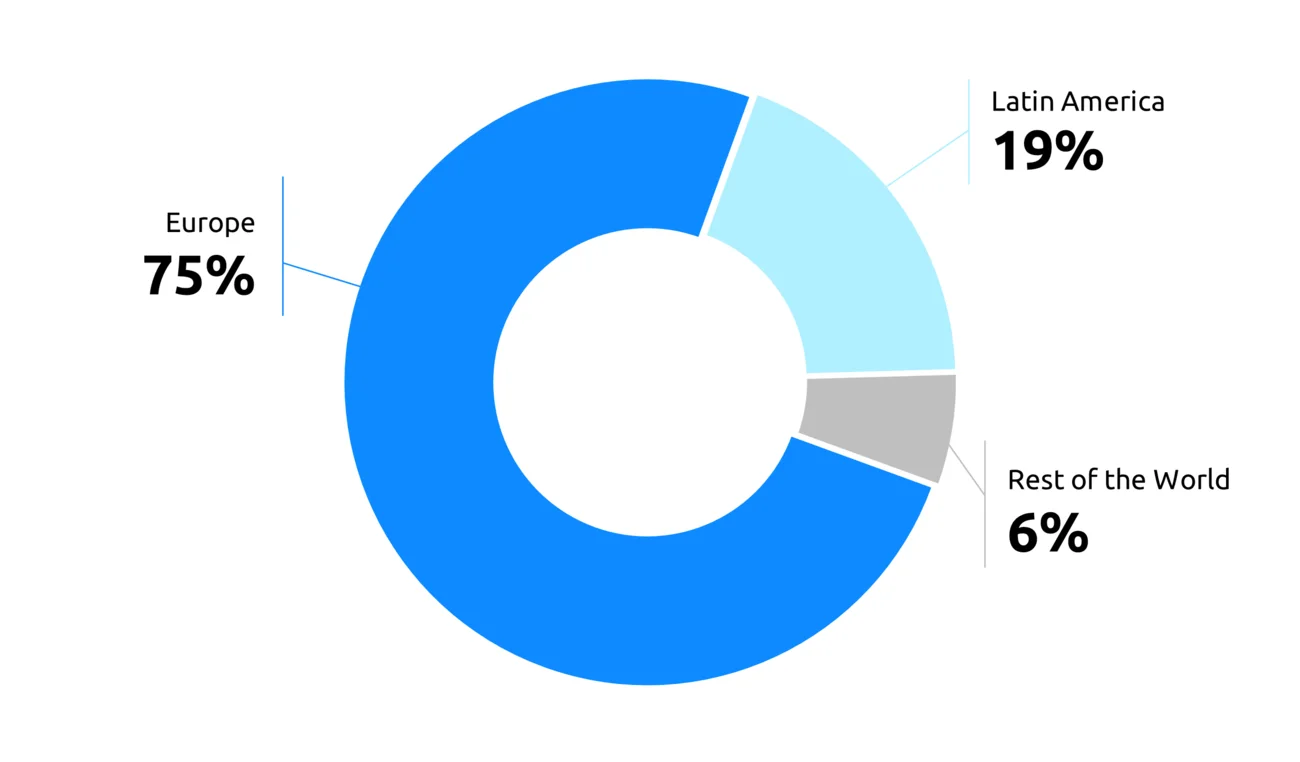

Breakdown of the invested funds as of December 31, 2024

By maturity

By geography

Note: The remuneration from the investments is recorded as financial revenue.

A cautious investment policy

To manage its treasury, the Group’s market risk management policy is designed to mitigate the capital, the liquidity and the counterparty risks.

Hence, most of the financial investments are made in monetary instruments (fixed-rate time deposits, term accounts, retail certificates of deposit or interest-bearing demand deposits).

Exposure to counterparty risk is reduced by:

- dealing only with leading counterparties according to correlated country risks;

- using a wide range of counterparties;

- setting exposure limits by counterparty;

- using a monthly reporting procedure to track the concentration of counterparty risk and the credit quality of the various counterparties (based on their credit ratings).

The majority of the Group’s available cash is managed under a centralized cash-management scheme enabling to reduce the Group’s risk exposure thanks to a centralized and regular monitoring.

Convertible Bond

| Currency | Amount (in million) | Number of bonds issued | Coupon | Maturity | Press release | |

|---|---|---|---|---|---|---|

| 06/14/21 | EUR | 400 | 6,173,792 | 0% per year | 7 years | PDF (155 KB) |

2023

2024

2025

Other bond issues prospectus

- EMTN Programme – November 2025 – Base prospectus (PDF, 1.5 MB)

- First supplement to the Base prospectus (PDF, 159 KB)

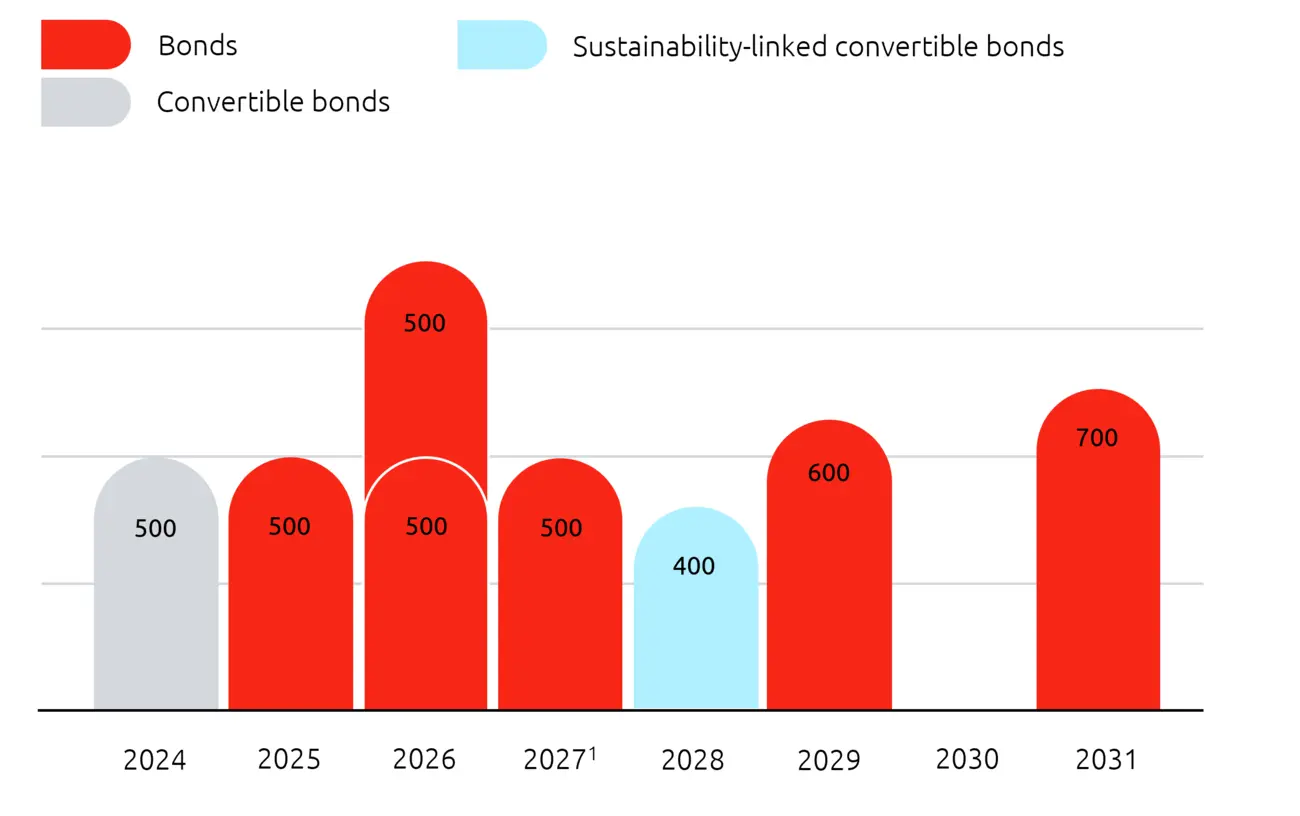

| Maturity | Amount (in € million) | Annual coupon | ISIN code | Rating (Standard & Poor's) | Press release | Official prospectus | |

|---|---|---|---|---|---|---|---|

| 01/08/26 | 7 years 01/15/2033 | 500 | 3.75% | FR0014015FW5 | A- | PDF (115 KB) | PDF (430 KB) |

| 02/20/25 | 5 years 6 months 08/27/2030 | 750 | 3.25% | FR001400UHA2 | A- | PDF (85 KB) | PDF (1 MB) |

| 07/29/24 | 8 years 08/04/2032 | 500 | 3.625% | FR001400QZ47 | A- | PDF (137 KB) | PDF (2 MB) |

| 06/09/23 | 3 years 6 months 12/13/2026 | 500 | 3.625% | FR001400IIT5 | A- | PDF (93 KB) | PDF (2 MB) |

| 06/09/23 | 8 years 06/13/2031 | 700 | 3.625% | FR001400IIU3 | A- | PDF (93 KB) | PDF (2 MB) |

| 06/18/20 | 9 years 06/18/2029 | 600 | 1.375% | FR0013518537 | A- | PDF (86 KB) | PDF (997 KB) |

| 12/06/18 | 7 years 3 months 03/06/2026 | 500 | 1.875% | FR0013385655 | A- | PDF (104 KB) | PDF (1 299 KB) |

| 03/30/17 | 10 years 03/30/2027 | 500 | 1.875% | FR0013247202 | A- | PDF (311 KB) | PDF (647 KB) |

General meeting of the holders of bonds

General meetings held in closed session – March 2021

As part of the conversion of the corporate form of the company EDENRED (the “Company”) through the adoption of the European company statute, the Board of Directors has decided to convene the general meetings of the holders of the bonds of the Company, as listed below, on March 18, 2021 (and, in case of lack of quorum, on March 29, 2021 on second convening):

- bonds issued on May 23, 2012 in an amount of €225,000,000 at the interest rate of 3.75% and due on May 23, 2022 (ISIN code: FR0011244367) at 9:30 a.m. (CET);

- bonds issued on March 10, 2015 in an amount of €500,000,000 at the interest rate of 1.375% and due on March 10, 2025 (ISIN code: FR0012599892) at 9:45 a.m. (CET);

- bonds issued on March 30, 2017 in an amount of €500,000,000 at the interest rate of 1.875% and due on March 30, 2027 (ISIN code: FR0013247202) at 10:00 a.m. (CET);

- bonds issued on December 6, 2018 in an amount of €500,000,000 at the interest rate of 1.875% and due on March 6, 2026 (ISIN code: FR0013385655) at 10:15 a.m. (CET);

- bonds issued on June 18, 2020 in an amount of €600,000,000 at the interest rate of 1.375% and Due on June 18, 2029 (ISIN code: FR0013518537) at 10:30 a.m. (CET).

Given the current sanitary context and the related restrictions, and in accordance with the provisions of Article 4 of Ordinance No. 2020-321 of March 25, 2020, the said general meetings of the holders of the bonds will exceptionally be held in closed session (at the Company's registered office located at 14-16 boulevard Garibaldi, 92130 Issy-les-Moulineaux, France), without the bondholders and other persons entitled to attend (other than the members of the executive committee (bureau) of each general meeting) being present, either physically or by telephone or audiovisual conference.

The conditions to participate in each of the general meetings appear in the convening notice dated March 3, 2021 (also available below), it being said that:

- each bondholder has the right to participate in the relevant general meeting by proxy or by correspondence;

- each general meeting will be chaired by the representative of the masse, as specified in the terms and conditions of each relevant bond;

- two tellers (scrutateurs) and the secretary of each general meeting will be appointed from among the Company's employees;

- the Company will provide live broadcasting of each general meeting by conference call, the access number of which will be provided upon request to the centralising agent (Société Générale Securities Services - 32, rue du champ de tir, CS 30812, 44308 Nantes, Cedex 03, France - +33 2 51 85 65 93 - agobligataire.fr@socgen.com). A recording of the meeting will also be available on the Company’s website.

You may find below all the documents relating to these general meetings of March 2021:

| Download | |

|---|---|

| Convening notice – General meetings of bondholders dated March 18, 2021 | PDF (134 KB) |

| Report of the Board of Directors – General meetings of bondholders dated March 2021 | PDF (133 KB) |

| Forms – General meetings of bondholders dated March 18, 2021 | PDF (363 KB) |

| Draft terms of conversion of Edenred to a European Company – December 2020 | PDF (355 KB) |

| Second convening – Convening notice – General meetings of bondholders dated March 29, 2021 | PDF (136 KB) |

| Forms – General meetings of bondholders dated March 29, 2021 | PDF (278 KB) |